Table of Content

The eligibility criteria for women are the same as for other applicants although women borrowers are given an interest rate concession of 05 basis points. State Bank of India’s home loan repayment tenure goes up to 30 years. The younger the individual is when the home loan is taken, the more number of years they have to repay the loan and vicce versa.

I have taken the loan amount of Rs. 7.5L and I have chosen the tenure period of 20 years. To sanctioned this loan almost they took 10 to 15 days. Since I'm a salary account holder, the documentation process was quite high.

Savings Accounts

Or a rented residence where the applicant has resided for at least 12 months before applying. She is eligible for a loan of INR 9 Lakh which can be used to complete renovation. But she uses the SBI Personal Loan EMI Calculator to see how much the EMI she will need to pay in return.

Make sure you can commit to the payments each month. SBI easy home loan EMI calculator, by simply entering the loan amount, interest rate and select the loan tenure from drop down. Your loan EMIs will remain the same throughout your loan tenor if you have availed the home loan on a fixed rate of interest. However, the principal and interest portion in each of them differs per month.

Documents required for Home Improvement Loans

I have already close the loan 5 years before and they have given me a NOC letter also. Use this free home renovation loan calculator to find the best rate and term for you. Using an EMI calculator is one of the first steps you take to apply for a home loan and purchase/construct your dream abode. The next steps involve arranging all the necessary documents and making sure you fulfill all the eligibility criteria. Home loans are one of the sought-after financing options from SBI since this bank offers the most attractive rate of interest. SBI home loan EMI calculator, borrowers can calculate their monthly installments before applying.

But one issue was faced that my documents not submitted to INDIA BULLS hence I have submitted again. The rate of interest is started with 8.35% gradually increased hence on last months was 8.90%. Their service is not good coordination with me. So, plan your house renovation with SBI lowest Personal Loan interest rate, and don’t forget to use the EMI calculator too. The affordable interest rates coupled with valuable inputs from the calculator will result in a smooth repayment experience. Home loans are long-term and secured financing options available for constructing or purchasing a property.

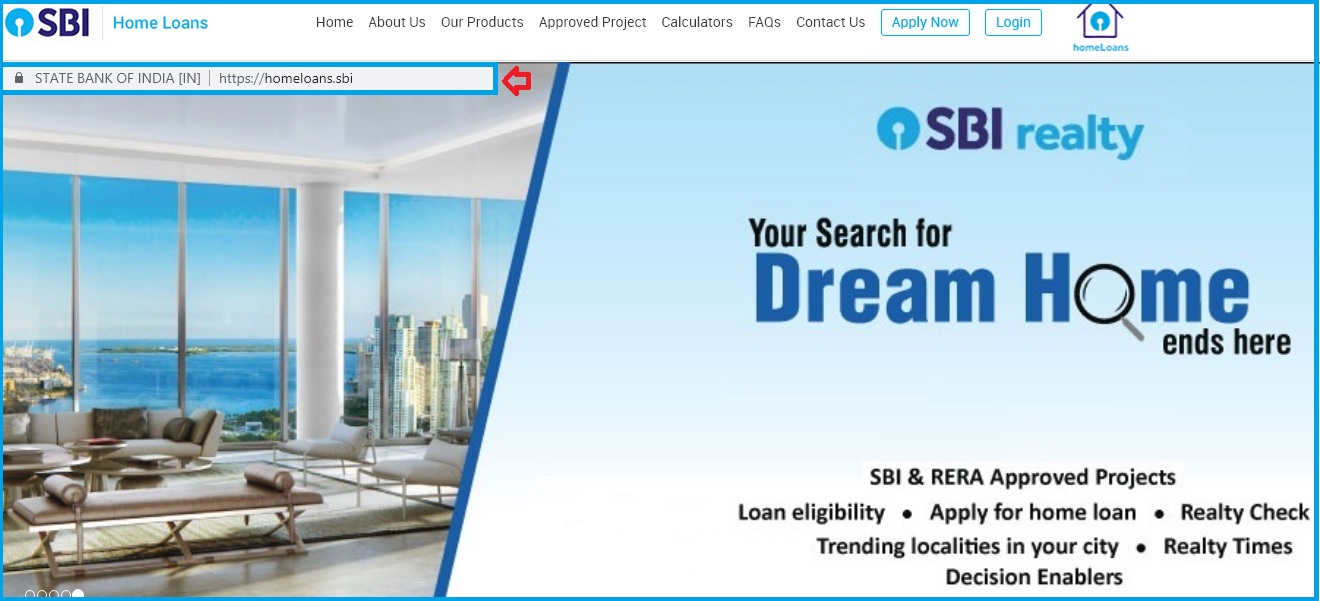

Intrested in SBI Home Loans ?

You can increase your chances of being approved for a State Bank of India home loan by adding a co-applicant who has a regular source of income, has a good credit score, and fits the age and Indian citizenship criteria as well. The calculator shows you how to calculate a new loan either in terms of loan duration or by EMI amounts. This gives you the choice of knowing how you want to handle the loan repayment.

We have a network that is unmatched in terms of reach. We have a network of + branches, sales teams and processing centers across the country to cater to the housing loan requirements of individual customers. Please click here to locate us and contact us for your home loan requirements. SBI is one of the reputed banks in India with more than 50 Crore customers in more than 25,000 branches.

According to the SBI website, the bank's EBLR is 7.55% +CRP as on 15 June 2022. This is the third time the MCLR rates have been increased.The bank also increased its RLLR and EBLR by 50 basis points to 7.65%. What are the processing fees for SBI home loans? SBI home loans have a consolidated processing fee which is 0.40% of the loan amount plus the applicable GST. The minimum amount is Rs.10,000 plus GST while the maximum amount is Rs.30,000 plus GST. I purchased a home loan from Axis bank in the year of 2011 Just because of my salary account is with them.

Individuals must have a good CIBIL score to avail the offer. A personal loan calculator is a critical tool that can help you calculate your home renovation loan based on crucial data such as the amount you borrow, the interest rate applicable on the loan, and the loan tenure. A personal loan calculator can help you plan your finances and work on an amount that does not affect your financial health or credit score. SBI Surakhsha State Bank of India's SBI Suraksha is a life insurance policy linked to the bank's home loan. The premium of this life insurance policy is paid by the bank.

To get the minimum rate of interest on your borrowed money, you need to ensure SBI that you’re eligible for the same. To prove your creditworthiness, you need to earn high and have a spotless repayment record. By clicking "Proceed" button, you will be redirected from SBI website to the resources located on servers maintained and operated by third parties. SBI doesn't take any responsibility for the images, pictures, plan, layout, size, cost, materials or any other contents in the said site.

There are a variety of home loan schemes with attractive interest rates and repayment tenure to meet varying requirements. The personal loan calculator will help you assess how much it can cost you every month to repay a loan at a given term. Luckily, you can opt for a personal loan that can also work as a home renovation loan. Before you pay for your home renovation expenses through a personal loan, you would need to consider the overall cost you may have to bear.

The information mentioned herein above is only for consumption by the client and such material should not be redistributed. Your home is constantly in need of a little extra love. Whether you have been residing in it for decades or may have just moved in, a home needs regular fixes or, in some cases, a massive overhaul. Financing such renovations or improvements may come at a huge cost which may not necessarily be available in your bank account. Pradhan Mantri Awas Yojana can help you save money on your first house.

I have taken INDUSIND home loan because my friend suggested it to me.The tenure of the loan is for 17 years with an interest rate of 11.5%. For submission of documents i have to run up and down apart from that it was fine.But it would have been good if the procedure is little short and not to deduct any installment from account without clearing the check first. The processing fee will be deducted from your loan amount and subject to 1.50%. The users should exercise due caution and/or seek independent advice before they make any decision or take any action on the basis of such information or other contents. These articles, the information therein and their other contents are for information purposes only. All views and/or recommendations are those of the concerned author personally and made purely for information purposes.

Documentation process is as usual like other banks. They have provided me a interest rate of 8.45%. At an Initial I took home loan from DHFL on sudden from their end transferred the process to INDIA BULLS without any intimation.

No comments:

Post a Comment